We believe in WIN-WIN SUCCESS over WIN-LOSE SCARCITY

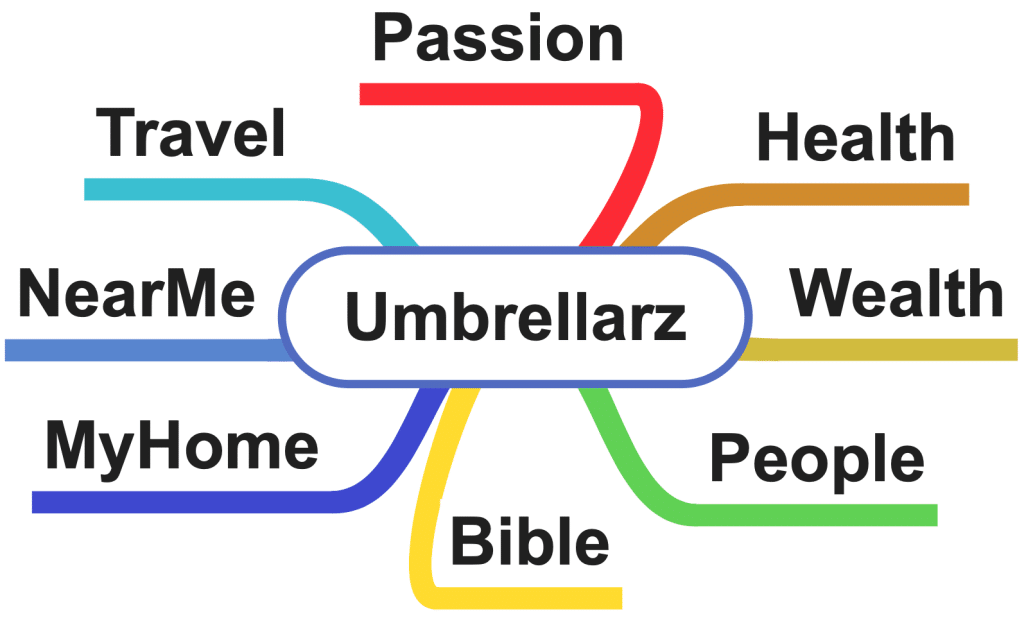

Our Umbrellarz community offers 100% TRANSPARENCY to see for yourself the THREE GLOBAL BRANDS we have VETTED and APPROVED with NO PRESSURE! As the choice to join us and be REWARDED is always yours!